2024 Sec 179 Electric Vehicles

2024 Sec 179 Electric Vehicles. This could be machinery, equipment, vehicles, furniture, fixtures, and certain types of real property. Limitations and restrictions of section 179 deduction for vehicles.

Can i take both the 179 (or bonus depreciation) and ev. Under the section 179 tax deduction:

For Tax Years Beginning In 2023, The Maximum Section 179 Expense Deduction Is $1,160,000.

Heavy suvs, pickups, and vans over 6000 lbs.

101 Rows For 2024, The Deduction Limit Is $1,220,000, With A Total Equipment Spending Cap Of $3,050,000.

Firstly, the property must be ‘section 179 property’ which is defined as property that is purchased for use in the active conduct of a business.

For 2023, A Vehicle Qualifying In The “Heavy” Category Has A Section 179 Tax Deduction Limit.

Images References :

Source: www.joerizzalincolnoforlandpark.com

Source: www.joerizzalincolnoforlandpark.com

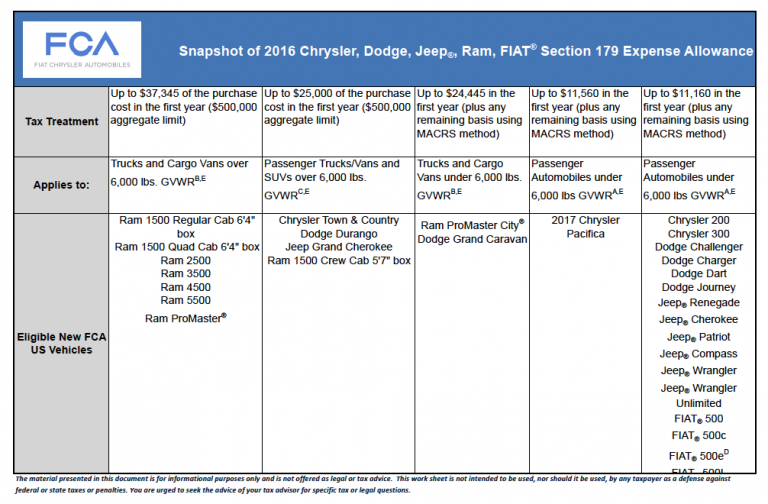

Lincoln Vehicles that Qualify for Section 179 Deduction, Nirmala sitharaman announced an ambitious plan. Firstly, the property must be ‘section 179 property’ which is defined as property that is purchased for use in the active conduct of a business.

Source: www.hickoryinternational.com

Source: www.hickoryinternational.com

Section 179 All Roads Kubota Bel Air Maryland, Its msrp starts at $79,990, and it has a 6,800. Section 179 and bonus depreciation deductions can be applied to listed property but with special considerations.

Source: www.dentonford.com

Source: www.dentonford.com

What Vehicles Are Eligible For Section 179? See Pickup Trucks & SUVs, 101 rows for 2024, the deduction limit is $1,220,000, with a total equipment spending cap of $3,050,000. For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000.

Source: www.balboacapital.com

Source: www.balboacapital.com

Section 179 Vehicles Infographic Balboa Capital, For vehicles under 6,000 pounds in the tax year. For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000.

Source: clarkcapitalfunds.com

Source: clarkcapitalfunds.com

Section 179, This luxury, crossover suv comes equipped with a 1,020 peak horsepower, electric engine. Purchasing an electric vehicle over the 6,000 lbs gvwr limit to place in service for a small business.

Source: www.commercialcreditgroup.com

Source: www.commercialcreditgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, This could be machinery, equipment, vehicles, furniture, fixtures, and certain types of real property. Qualifying vehicles must be more than 50% of the vehicle’s use for business purposes.

Source: www.esialaska.com

Source: www.esialaska.com

Lower your operating costs with Section 179 Equipment Source Inc., For vehicles under 6,000 pounds in the tax year. And mainly used for business can get a partial deduction and bonus.

Source: blog.fcaworkvehiclesus.com

Source: blog.fcaworkvehiclesus.com

Section 179 Work Vehicles, Work Sheets and What You Need to KnowFCA, Special rules for heavy suvs: 101 rows for 2024, the deduction limit is $1,220,000, with a total equipment spending cap of $3,050,000.

Source: www.bestpack.com

Source: www.bestpack.com

Section 179 in 2022 BestPackBestPack, Nirmala sitharaman announced an ambitious plan. And mainly used for business can get a partial deduction and bonus.

Source: gpstrackit.com

Source: gpstrackit.com

The Ultimate Fleet Tax Guide Section 179 GPS Trackit, And mainly used for business can get a partial deduction and bonus. Under the section 179 tax deduction:

Finance Minister Nirmala Sitharaman Unveiled Significant Initiatives In The 2024 Interim Budget To Bolster Electric Vehicle (Ev) Expansion In India, Focusing On.

And mainly used for business can get a partial deduction and bonus.

New Vehicles Eligible For The $7,500 Tax Credit On Or After Jan.

Firstly, the property must be ‘section 179 property’ which is defined as property that is purchased for use in the active conduct of a business.