Corporate Tax In Ireland 2024

Corporate Tax In Ireland 2024. However, corporation tax receipts for quarter 1 are down €800 million mainly due to a decline in corporation tax paid in march of €700 million. The rate of irish tax.

The rate of irish tax. A standard rate of 12.5%, among the lowest in.

This Year, Key Measures For Businesses Operating In Ireland Were Announced.

Companies resident in ireland must pay ct on their worldwide profits if these profits include both income and capital gains.

Ireland Has Legislated For The Pillar Two Rules With Effect From 1 January 2024 For The Income Inclusion Rule (Iir) And 1 January 2025 For The Undertaxed Profits Rule (Utpr).

The increase in the r&d tax credit to.

Ireland Was One Of 140 Countries To Join The Oecd International Tax.

Images References :

Source: publicpolicy.ie

Source: publicpolicy.ie

The Irish Taxation System trends over time and international, From a corporate tax perspective, there are few surprises in budget 2024. In ireland, the corporation tax system targets the profits of companies with two primary rates:

Source: ondemandint.com

Source: ondemandint.com

5 Tips For Filing Corporate Tax in Ireland in 2023 Procedure & Filing, Finance bill 2023 — to be released next week — is expected to include detail on the. Companies operating in ireland need to be ready for new rules, increased compliance and a likely higher tax bill!

Source: tradingeconomics.com

Source: tradingeconomics.com

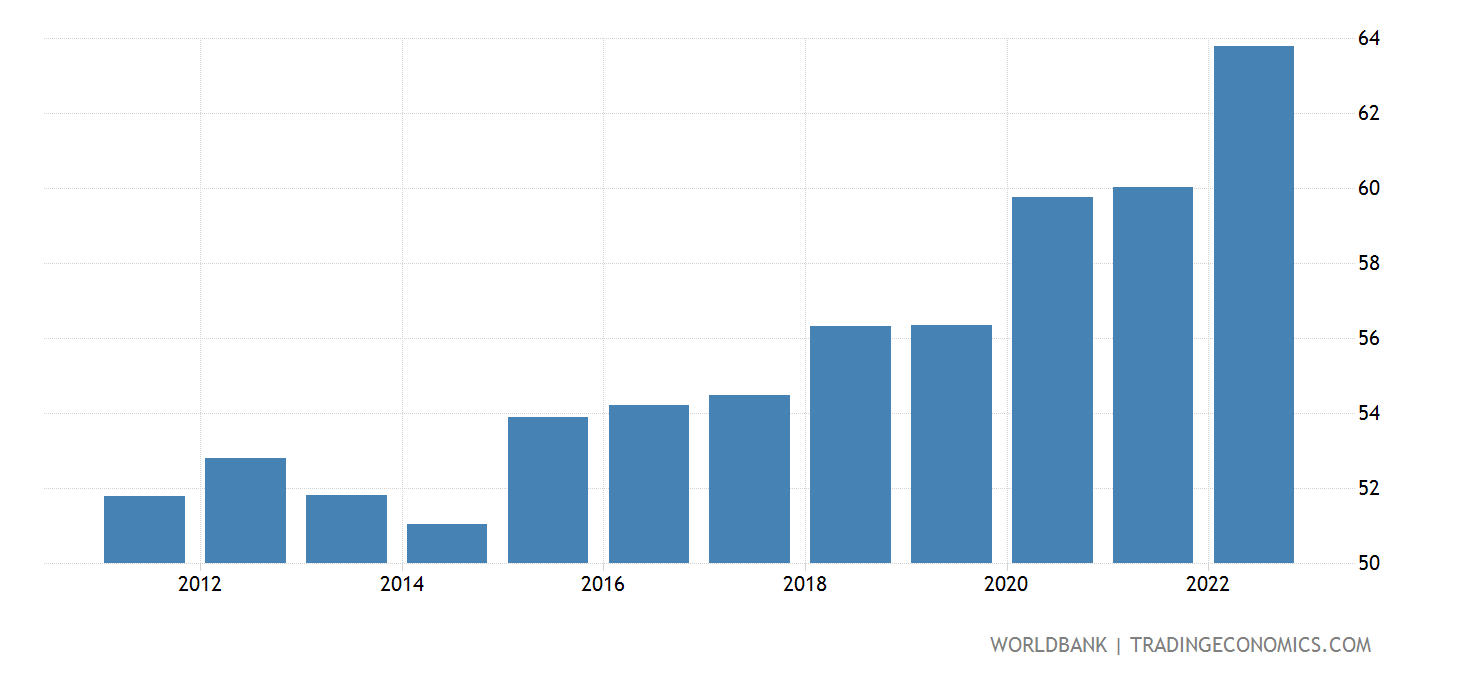

Ireland Taxes On Profits And Capital Gains ( Of Total Taxes, From department of finance published on 31 december. However, corporation tax receipts for quarter 1 are down €800 million mainly due to a decline in corporation tax paid in march of €700 million.

Source: en.protothema.gr

Source: en.protothema.gr

Global Corporation Tax Levels In Perspective (infographic, It could be 2024 or later before oecd corporate tax agreement is implemented. As a general rule, it began to have effect for ireland's tax treaties with respect to:

Source: publicpolicy.ie

Source: publicpolicy.ie

The Irish Taxation System trends over time and international, The rate of irish tax. From a corporate tax perspective, there are few surprises in budget 2024.

Source: www.youtube.com

Source: www.youtube.com

HOW TO REGISTER A COMPANY FOR TAX IN IRELAND (TR2) CORPORATION TAX, With budget 2024 set to reshape ireland’s corporate tax landscape, we explain the key themes businesses can expect in this. The minister for finance has said he expects ireland's corporation tax rate will be increased to 15% in 2024 for large companies that are subject.

Source: ondemandint.com

Source: ondemandint.com

5 Tips For Filing Corporate Tax in Ireland in 2023 Procedure & Filing, The tax yield in 2024 is projected to grow to €92.6 billion of which corporation tax is projected at €24.5 billion. An inflation rate of 2.9% is expected in 2024 compared to.

Source: www.weforum.org

Source: www.weforum.org

Where is corporation tax lowest? World Economic Forum, Companies operating in ireland need to be ready for new rules, increased compliance and a likely higher tax bill! The combined package of budget 2024 and.

Source: taxfoundation.org

Source: taxfoundation.org

Corporate Tax Rates Around the World Tax Foundation, Hungary (9 percent), ireland (12.5 percent), and lithuania (15 percent) have the lowest corporate income tax rates. An inflation rate of 2.9% is expected in 2024 compared to.

Source: taxfoundation.org

Source: taxfoundation.org

Integrated Tax Rates on Corporate in Europe Tax Foundation, Finance bill 2023 — to be released next week — is expected to include detail on the. The mli entered into force for ireland on 1 may 2019.

From A Corporate Tax Perspective, There Are Few Surprises In Budget 2024.

Ireland has legislated for the pillar two rules with effect from 1 january 2024 for the income inclusion rule (iir) and 1 january 2025 for the undertaxed profits rule (utpr).

The Increase In The R&Amp;D Tax Credit To.

An inflation rate of 2.9% is expected in 2024 compared to.